The Best Budgeting Apps for Personal Finance in 2020

It’s hard to believe, but we’re halfway through 2025. For those of you that made the New Year’s resolution to do a job of saving money and your budgeting – how’s that going? If the answer is not great, fear not. In this article, we’ve compiled a great list of best personal finance apps for your Android, IOS and web-based devices to help you better understand and monitor your financial picture and also help improve your financial strength. Our goal was to capture the best budgeting apps of 2025, for both iPhone & Android devices, that can be used for personal finance as well as book-keeping for businesses.

What is a Budget?

Personal Finance

Personal finance is all about managing your expenses, income, savings and investing. Study which educational resources can guide your planning and choose a personal spending habit that will help you make the best money-management decisions.

Mega Bundle Sale is ON! Get ALL of our React Native codebases at 90% OFF discount 🔥

Get the Mega BundleBudget

A budget is a breakdown with a plan for your income and expenditures over a period of time. Could you imagine a business becoming successful if it didn’t keep track of its income and expenses periodically? The same holds true when it comes to your personal finances. However, without a well-defined budget and a plan for managing your spending each month, your road to financial success could end up being a lot difficult than it needs to be.

Budgeting Apps

Living without a budget is like traveling without a map. Keeping track of your spending and setting budgets can be a great way to save money and achieve any financial goals. Budgeting is a practice of discipline and habit. If you keep track of your income and expenditures every month, you’ll be able to manage your money more efficiently and reach your financial goals in no time.

Most consumers have more than one credit card accounts, savings accounts, and debit cards that they use to make purchases. However, recording spendings manually on paper can be time-consuming at best and an impossible endeavor at worst. This is where mobile budgeting apps come in.

Budgeting apps give you the insight of what you are spending money on when linked directly to your bank account. Everything gets automated, and the budgeting process becomes frictionless. Let the technology do the hard parts of your life for you.

Features of Budgeting Apps

There are a large number of the best budgeting apps for iPhone and Android to choose from. While many of these apps share similar features, the best one for you will depend on a number of factors. Here are some of the features you might want to look for in a budgeting app

Compatibility with your platform of choice

A budgeting app should have both an Android, IOS and Web version for consumers to provide a wide variety of choices. Having more options is useful if you want to keep a constant eye on your finances.

A desktop version can be advantageous if you are budgeting with a partner and want an easy way to go through your finances. Unfortunately, Mac users and consumers who only use a mobile phone or tablet will have their personal finance software options limited. Before you commit to a budgeting app, check and make sure that it’s compatible with the platform of choice.

Alert Features

Missing a contribution payment doesn’t just disrupt your budget plans, it can also cause your budget to accumulate unpaid contributions. If you have multiple credit cards, the chances are you’ve forgotten at least once when a bill is due. A good mobile budgeting app should focus on keeping you on track towards your budgeting and saving by offering comprehensive alert features via email, SMS and push notifications; they can tell you when bills are due, you’re overspending in a certain budget category, or you’re approaching the deadline to make a contribution to your retirement account for the year and other several financial obligations.

Security

This is probably the most important feature of any budgeting app. The use of mobile devices continues to increase around the world. Some app developers try to sell their users’ data to unauthorized third-parties. A budgeting app must have great security measures and not use your data for any other reason than the improvement of the app. It should also have a policy in place that covers you in the event of a breach of security and covers any charges related to fraud or stolen personal information.

Mega Bundle Sale is ON! Get ALL of our React Native codebases at 90% OFF discount 🔥

Get the Mega BundleIncome and Expenditure Monitoring System

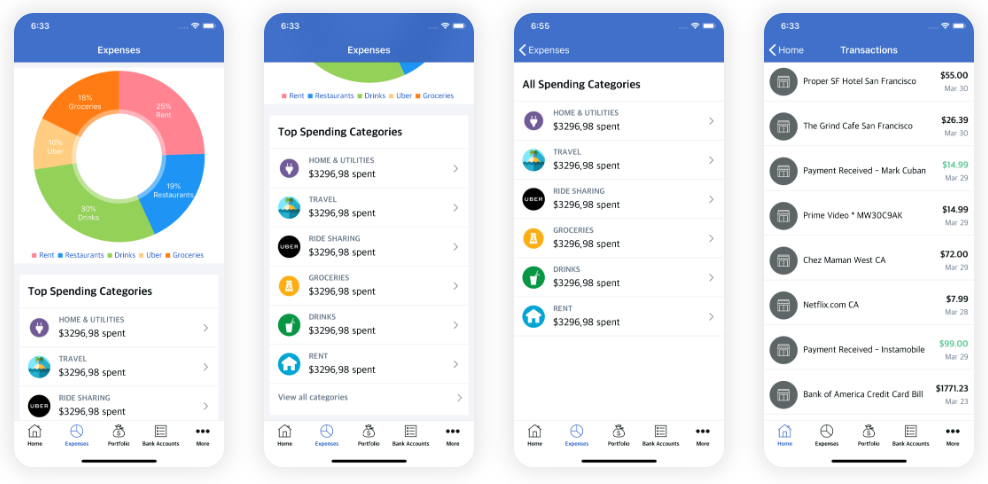

Incomes and expenditures are the fundamental factors in planning a budget. A key feature of a budgeting app is that it shows you the amount of money you have spent, as well as what you have spent your money on. By categorizing your spending, the apps let users take note of monetary loopholes (do you really need that daily tea and cake?) and reign in your spending in these categories.

Some of the apps also compare your spending in a given month to your average, which allows you to see if you are spending more than you usually do. Oftentimes you’ll realize that by just making a few small adjustments to your spending habits, you can significantly improve your situation and achieve your goals.

Simplicity

Simplicity is the product of technical subtlety. If you download the best budgeting app that can solve your financial problems, but you can’t use it due to its complexity, you won’t be using that app for much longer. The best budgeting apps should be simple and easy to use for an average mobile phone user. It allows you to track your expenses and create your budget easily. With a powerful budgeting app, you can have all your accounts, budgets and transactions in one place and access them whenever you want, wherever you want.

Setting Financial Goals

The best budgeting apps should have goal tracking feature that estimates how your current spending and income will affect your set goals. This is particularly useful if you have a certain goal you are aiming for, such as buying a house, getting a new car or sending your kids to college. A goal tracking feature lets you know early on if your spending habits are helping you reach your goals or to make adjustments if you aren’t reaching your set goals.

What is the Best Mobile App for Budgeting?

That’s obviously a subjective question. Sticking to a budget, managing money and even making investment decisions are made easier than ever before, given the plethora of personal finance apps out there. But not every mobile budgeting app is worth downloading. You can take some of the guesswork out of digitizing your finances with this list of top budgeting apps i.e. personal finance and business apps of 2025.

Each of the apps is recommended the “best” for a particular purpose, although several fulfill more than one purpose. Let’s take a look at some of the best apps with their unique purposes. We’ll look at each app, it features and some pretty unique ways to budget.

-

Best Budgeting App for Couples: Honeydue

-

Best Budgeting App for freelancers: Tycoon

-

Best App for Money Management: Mint

-

Best App for paying debt: You Need A Budget

-

Best Investment App: Robin hood

-

Best App for Tracking Expenses: Wally

-

Best App for Easy Saving: Acorns

Best Budgeting App for Couples: Honeydue

Honeydue is a unique app that is focused on couples budgeting. With this app, you can sync your account with your partner, allowing both of you to see all of your bank and credit card account activity in one place. It automatically categorizes expenses, track shared bills, give remarks on transactions and help set couple goals together. This helps them stay focused on their daily work and not get caught in the weeds, arguing over small rifts. Honeydue is a great choice for users who want a simple solution to household financial planning.

Special features: With the special household feature, there is an easy division of bills, expenses, and two-factor authorization.

Best Budgeting App for Freelancers: Tycoon It’s hard for freelancers to keep track of multiple projects, especially since they’re usually in the middle of one when another comes in. Tycoon is the best app for freelancers who handle a variety of tasks by tracking all your projects, gigs and remember if you’ve been paid or not.

Consider it a balance sheet designed just for you. Though popular with those in the fashion industry (photographers, stylists, etc.). Tycoon can be valuable to any freelancer as it lets you digitize the details of a gig, set a schedule for it, and keep track of payments that have come in, are scheduled to come in, or that are past due – your own little income and expenditure sheet, so to speak. It also makes it easy to see, at a glance, which clients have not paid you yet.

Special features: Tycoon App is created for a freelancer’s needs, such as calculating take-home pay (minus taxes and agent commission) so you can decide whether or not to even accept a new gig.

Mega Bundle Sale is ON! Get ALL of our React Native codebases at 90% OFF discount 🔥

Get the Mega BundleBest App for Money Management: Mint

Mint is by far one of the most popular budgeting apps available on the market. Created by Intuit Inc., the founders of QuickBooks and TurboTax. Mint is a powerful budgeting app that has plenty of features to help your spending by showing you your real credit score across all your accounts and cards. It allows you to keep track of where your money goes by linking all your accounts to the app. You can also use it to create budgets which will alert you if you need to adjust your spending.

Mint lets you know your debt details, your bills due date, and what you can afford to pay (based on your available funds). The app can also send you payment alerts or warn you if you’re approaching budget limits. Based on your habits, Mint even gives you tips and advice over your spending. Mint also give free credit score tracking. The app only supports financial institutions in Canada and the U.S.

It’s available for Android, iOS and web version so you can use it across platforms.

Best App for paying debt: You Need a Budget

You Need a Budget (YNAB) is different from every other budgeting app you’ve used before. It’s built around a fairly simple principle – every dollar has a “job” in your personal budget, be it for retirement, for debt repayment, or to cover other expenses.

You Need a Budget doesn’t let you create budgets around money you don’t have – it guides you to live within your actual income. If you get off track (which happens frequently), YNAB helps you see what you need to do to balance your budget. The special “accountability partner” feature keeps you on your toes about your personal financing as a whole.

However, users pay a monthly or annual fee for YNAB, many feel the service and support are worth it. Online classes with a live instructor for Q&A to help you learn personal financing basics are included. YNAB is so effective that the average user pays off $500 in debt the first month. The financial commitment should encourage you to use the app in the subsequent month. Even if it’s not free, this app is still one of the best mobile budgeting apps on the market.

It’s available for Android, iOS and in a web version so you can use it across platforms of your choice.

Best Investment App: Robinhood

Robinhood is a life-changing investment app with a very unique and unrivaled feature. It helps you invest in the stock market, ETFs, American depository receipts (ADRs) and cryptocurrencies without commission rates. It also allows you to see everything in one place.

This app will help you discover new stocks, investment opportunities and how to invest wisely. After you begin trading, you’ll see all your assets laid out in charts to stay on top of your investments. It’s also one of the very first investing apps to offer Bitcoin trading capabilities. There are no minimum or maintenance fees for any types of accounts.

The simple layout of the app makes getting into investing a smooth experience. Easy to navigate, you’ll quickly understand how to search and view the latest stocks, buy them, sell them, and read your financial portfolio.

It’s available for Android, iOS and in a web version so you can use it across platforms of your choice.

Special features: “Cards” appear on your screen to give you real-time trade alerts and market information; which you can customize to suit your taste.

Mega Bundle Sale is ON! Get ALL of our React Native codebases at 90% OFF discount 🔥

Get the Mega BundleBest App for Tracking Expenses: Wally

If you’re the type of person who’d love to be as organized with tracking your personal expenses as you are with filing your office expense reports, the Wally app is just the best for you. One to the difficult things about tracking your expenses is the data entry part. Instead of manually inputting your expenses at the end of the day (or week or month), Wally lets you scan your receipts, set a savings target, track your expenses and income and enter them.

If your device geo-location is on, wally will automatically identify and categorize where you are so you just need to enter the amount you spent. While smart notifications remind you of important things like an upcoming payment or an achieved goal. The more you use Wally, the smarter it becomes by adapting to your preferences and providing detailed insight into your finances.

Special features: You can take a picture of receipts and export the data to excel document instead of manually entering numbers.

Best App for Easy Saving: Acorns

This app won’t necessarily help you save money — but it’ll help you generate more. With Acorns, you can invest as little as five dollars into different portfolios of low-cost exchange-traded funds (ETFs) that you select based on your risk preference whenever you have the spare cash and watch your investments grow exponentially. Using this app is an easy way to save money in an automatic, stress-free way– many users say that they never notice the difference. Wouldn’t you love to find an extra $200 or $400 or even $700 in your investment account at the end of the year?

The service is free to college students, and pricing starts at just $1 per month for pretty much everyone else. Acorns can also help with your IRA and retirement savings. The app will also give you tips and advice as you continue to use it.

Special features: You can set up your Acorn app to automatically invest your savings without knowing about it.

Looking for a custom mobile application?

Our team of expert mobile developers can help you build a custom mobile app that meets your specific needs.

Get in TouchFinal Thoughts

Even if you aren’t falling behind on your expenses and other bills, organizing your expenses with a budgeting app is still a good habit to inculcate. Budgeting apps can help you work towards your new financial goals without feeling like you’re constantly depriving yourself of the fun spending – things like family dinner out, seeing a movie, even a vacation trip to beautiful cities around the world. In reality, a budget is a tool, not a punishment. START MAKING YOUR BUDGET TODAY.

If you are on the research phase on how to make your own awesome budgeting app, don’t forget to take a look at our awesome app templates.